November is Financial Literacy Month, and this year, the theme is “Money on your Mind. Talk about it!” At Teachers on Call in-person and online tutoring, we believe that financial literacy is not just an important skill—it’s a vital life lesson that should be introduced early. By teaching children the fundamentals of money management, savings, budgeting, and spending, we equip them with the tools they need to make informed decisions that will serve them throughout their lives. Keep reading to see our latest Hooked on Books interview with Canadian children’s author, Cinders McLeod, about starting financial conversations early.

The goal of Financial Literacy Month is to empower Canadians to make smarter financial choices, from budgeting and managing debt to saving for the future and understanding credit. This year’s theme encourages families, educators, and communities to engage in open, honest conversations about finances—something many of us may avoid but can have a profound impact on future financial well-being. Many parents aren't sure where to begin when it comes to teaching kids about money. Read on for practical tips and advice from Cinders McLeod to help make financial literacy accessible and understandable for young learners

When to Start Talking About Money

A common question is: When is the right time to begin talking to kids about money? The truth is, the earlier, the better. In today’s world, which is filled with financial complexity, children benefit from understanding the basics of money from a young age. Early financial education can help them develop critical thinking, problem-solving skills, and the ability to make responsible decisions as they grow.

By introducing concepts like saving, budgeting, and planning, we give children the foundation they need to navigate the financial challenges they will inevitably face as adults. Financial literacy is more than just about money—it’s about developing smart habits, emotional intelligence, and long-term planning.

Whether it’s in the middle of a game of Monopoly, during a family outing, doing math homework, or while reading a story at bedtime, these moments can serve as great opportunities to start discussions about finances. Parents, educators, and caregivers can make learning about money fun and engaging, turning these conversations into valuable life lessons. Forbes recently detailed how prioritizing financial literacy with children can help ensure they make smart lifelong financial decisions.

Fun Stories for Teaching Kids About Finances

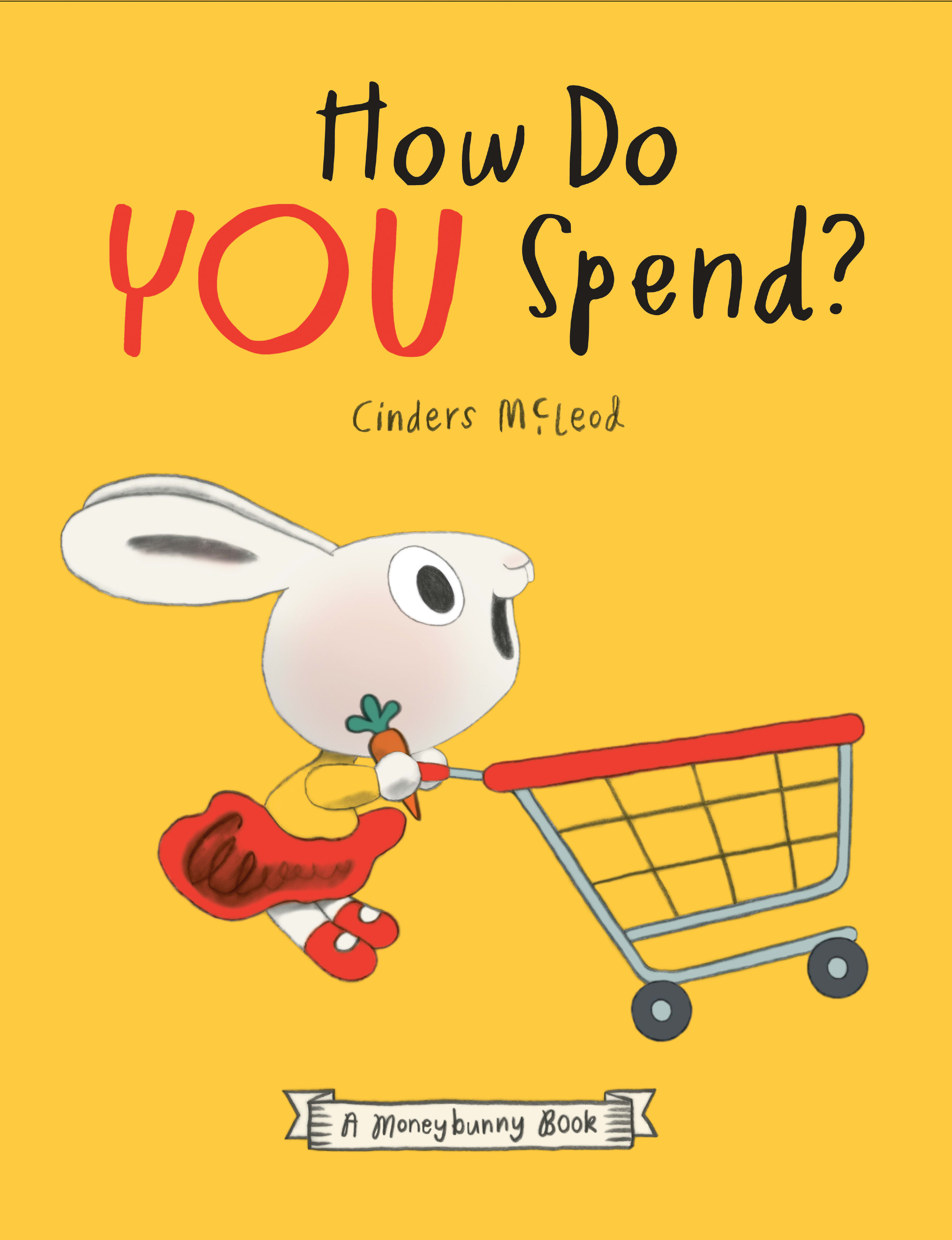

Cinders McLeod's *Moneybunny* series is a delightful and engaging way to introduce young readers to the world of money and personal finance. With charming illustrations and relatable storytelling, the series follows the adventures of Bunny and friends as they navigate important lessons about saving, spending, budgeting, and sharing. Designed for children, the *Moneybunny* books make financial concepts approachable and entertaining, helping kids develop positive attitudes towards money and smart habits that will serve them for a lifetime.

Whether it’s figuring out how to save for something special or understanding the value of teamwork and generosity, each story in the series brings important lessons to life in a way that’s both educational and enjoyable. The fifth book in the series, How Do You Spend? was released in September 2024 with a target age range of 3-5 years. We have the pleasure to speak with Moneybunny series creator, Cinders McLeod, to talk about starting conversations with children this Financial Literacy Month.

About the Author: Cinders McLeod

Cinders McLeod is an author and illustrator born in Toronto, Ontario. She is known for her captivating storytelling and charming illustrations that bring important life lessons to young readers. With a background in visual arts and a passion for children’s literature, Cinders has built a reputation for creating engaging, thought-provoking books that both entertain and educate. Her work spans a variety of genres, with a particular focus on teaching young readers about the world around them in a fun and accessible way. When she’s not writing or illustrating, Cinders can often be found in schools and libraries, sharing her love of reading with children of all ages.

Hooked on Books Talking Money Matters with Cinders McLeod

1. Your Moneybunny series has created an incredible opening for parents to talk about financial literacy with their children, how else can we help continue the conversation?Be sensitive to their stages. If children start to ask questions about money, that’s a good time to begin the conversation. We don’t want to overwhelm our little bunnies! The Moneybunny books are a great gauge to see where they are at in their money ponders. Some parents copy the graphic (chart) pages and create their own counters and problems to solve.

Another fine thing to do is to keep money jars for EARN, SPEND, SAVE and GIVE. This helps children get a visual of what their money is doing, rather than disappearing into the digital pool.

2. What impact do you believe having open communication about finances and spending can have on their future financial habits?

Here’s the bad news: Our children live in a tougher world with homes priced out of reach and jobs sought with little hope. Here’s the good news: Some lessons come in humorous and colourful picture books because we really don’t want to terrify our little bunnies. And these lessons can be gently planted, waiting to blossom into a greater awareness that will help guide them for the rest of their lives.

Parents quite often contact me to let me know the positive effects the books have on their children. One mother said she would regularly take her son on a Saturday allowance-spree at their local dollar store. After reading the Moneybunny Book SAVE IT! they went as usual but this time her son had a look around, didn’t see anything he wanted then announced to his mum that he was going to save up his money and buy something really special.

3. What can readers expect from the books?

Well, the dedication in each book reveals that books’ teachings:

EARN IT! pride and independence

SPEND IT! choice and wisdom

SAVE IT! planning and patience

GIVE IT! love and gratitude

And each book has a theme and a lesson: Each of the first 4 books starts out with something the bunny wants, and ends with the bunny discovering something more valuable.

In EARN IT! Bun wants to be RICH & FAMOUS but learns that takes work

In SPEND IT! Sonny wants to BUY EVERYTHING, but learns to make choices

In SAVE IT! Honey wants HER OWN PLACE but learns that take patience

In GIVE IT! Chummy wants to SAVE THE WORLD but learns heroes don’t need costumes

All these lessons are valuable for setting the groundwork for financial literacy.

4. What are some common misconceptions about financial literacy that you think parents and educators should address with children?

I think parents and educators should start with the basic building blocks of financial literacy: Earn, Spend, Save and Give. From what I have seen in the teaching of financial literacy in schools it’s just about counting (how many nickels in a quarter?). I call this “nickel and diming.” Of course counting and math is important, but as a later lesson. It’s like when someone does a watercolour painting. The first layer is the wash. Then the details are added to it once you know what details you need to add.

Why do I use carrots as Money in Bunnyland? I wanted the Moneybunny Books to focus on the idea of money. That’s why I used the international currency of carrots. I wanted to get away from nickel and diming and focus on the big concepts with a currency that could cross borders – which they do. My books are sold all over the world.

5. How can schools better integrate financial literacy into their curricula? What changes would you like to see in educational approaches to this topic?

I’d like to see more schools use my Moneybunny Books as textbooks! And as explained, more general thinking about the world of money to start with. The details can wait. I am also at the play testing stage of my Moneybunnies board game “A-Bun-Dance,” and my Moneybunnies card game “Flying Carrots.” These two games, once published, will be an excellent addition to the Moneybunny books.

6. How might parents and teachers further explore the concepts we learned in Bunnyland in the real world?

There’s a free download of “My Money Diary: Keep Out!” booklet on my www.moneybunnies.com website which can be a valuable aid to actually working out your child’s pocket money with them. There are also other fun activity sheets such as cards, jar labels counting and colouring pages.

Did you miss our previous interview with Cinders McLeod? Check out what Cinders had to tell our Teachers on Call team.

At Teachers on Call, we encourage parents and educators to take part in these important financial conversations and help create a future generation of informed, confident individuals who are equipped to make thoughtful financial decisions. Financial Literacy Month is a reminder that teaching kids about money isn’t just about numbers—it’s about empowering them to take control of their financial futures. Let’s make financial literacy a priority, today and every day.

Related Articles View All

Hooked on Books with Colleen Nelson and Kathie MacIsaac’s See It, Dream It, Do It: How 25 People Just Like You Found Their Dream Jobs

In our latest Hooked on Books, we're talking about exploring dream jobs with Colleen Nelson and Kathie MacIsaac on their Forest of Reading nominated book, See It, Dream It, Do It: How 25 People Just Like You Found Their Dream Jobs

Forest of Reading 2025 Nominees: Recognizing Canadian Authors and Illustrators

The 2025 Forest of Reading Nominees are here! This long anticipated, curated list recognizes some of the greatest Canadian authors and illustrators of the year. Dive into this year's lineup and explore the amazing stories and creators that have been unveiled!